Table of Contents

Click Here -> Direct Link to Scorecard

Key Features of Effective FP&A Tools

Identifying Your Business Needs

Assessing Your Current Financial Processes

Defining Your FP&A Requirements

Evaluating Different FP&A Tools

Click Here -> Direct Link to Scorecard

Reviewing Vendor Reputation and Support

Prioritize, Evaluate, Choose

We've created a comprehensive prioritization & evaluation scorecard to help you on your journey. Here's a direct link to the priority list to get started - but we'll explain what to be wary of.

Click Here -> Direct Link to Scorecard

Key Features of Effective FP&A Tools

When searching for the perfect FP&A tool, keep an eye out for these key features:

- Real-time Data Integration: Look for tools that can seamlessly integrate with your existing systems to provide up-to-date financial insights. Real-time data integration ensures that you have access to the most accurate and current information, enabling you to make timely decisions.

- Customizable Dashboards: A user-friendly and customizable interface allows you to track the metrics that matter most to your business. Whether it's revenue, expenses, or profitability, you can tailor the dashboard to display the information that is relevant to your specific needs.

- Forecasting Capabilities: The ability to forecast future financial performance is a game-changer for strategic planning and risk management. With forecasting capabilities, you can anticipate potential challenges and opportunities, allowing you to take proactive measures to mitigate risks and capitalize on market trends.

- Data Visualization: Clear and visually appealing charts and graphs make it easier to interpret complex financial data. Instead of sifting through spreadsheets and numbers, data visualization allows you to quickly grasp the key insights and trends, enabling you to make faster and more informed decisions.

- Collaboration and Workflow: Choose a tool that facilitates collaboration between different teams and streamlines financial workflows. By enabling seamless communication and data sharing, collaboration features ensure that everyone is on the same page and working towards common financial goals.

Identifying Your Business Needs

Now that you have a solid understanding of the importance of FP&A tools, it's time to identify your specific business needs. What financial processes are currently in place? What are the pain points, bottlenecks, and areas for improvement? Ask yourself these questions to gain clarity on what you're looking for in an FP&A tool.

Assessing Your Current Financial Processes

Take stock of your existing financial processes and evaluate their effectiveness. Are your financial reports accurate and timely? Does your current system provide insights into key performance indicators? Identifying the gaps in your current financial processes will help you pinpoint the features you need in an FP&A tool.

Defining Your FP&A Requirements

Now that you know where your current processes fall short, it's time to define your FP&A requirements. What specific functionalities do you need? Do you require advanced forecasting capabilities or automated reporting? Outline your must-have features and prioritize them based on their importance to your business.

Evaluating Different FP&A Tools

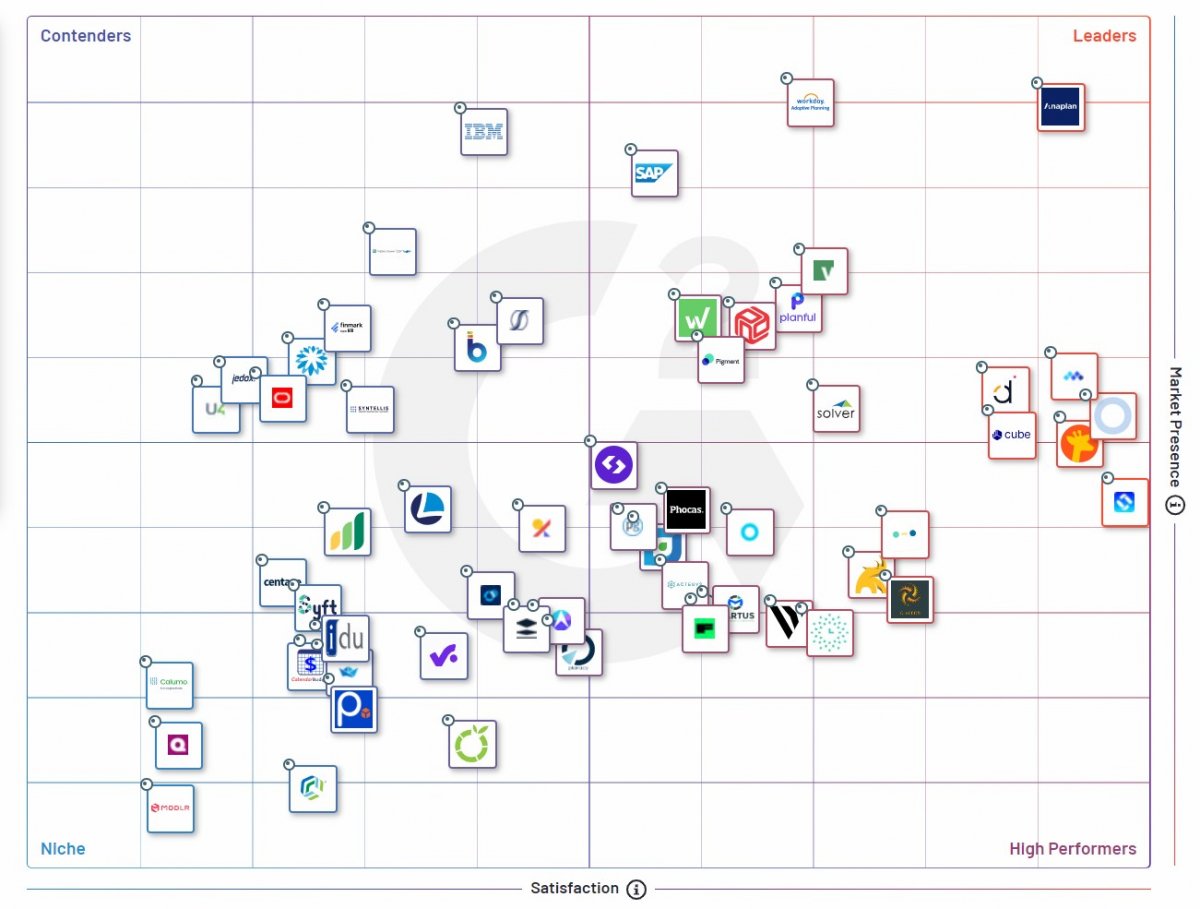

The current G2 grid gives us a high-level view into current tools on the market. There's plenty of contenders, and each one will have its own key differentiators.

G2 Grid for Budgeting & Forecasting Tools (2023)

Comparing FP&A Tool Features

We've compiled an exhaustive list of the most important questions to ask vendors throughout your evaluation process. Not all questions will be relevant to your key requirements, but should provide a good starting point during your search.

Click Here -> Direct Link to Scorecard

Reviewing Vendor Reputation and Support

While features are undoubtedly important, it's equally crucial to assess the reputation and support offered by the vendors. Read reviews, seek referrals from trusted sources, and evaluate the vendor's track record in terms of customer satisfaction and ongoing support. The last thing you want is to invest in an FP&A tool that leaves you high and dry when you need assistance the most.

Bonus: Future Trends in FP&A Tools

As technology continues to advance, the future of FP&A tools looks promising. Here are a couple of trends to keep an eye on:

Predictive Analytics

The integration of predictive analytics into FP&A tools is revolutionizing business forecasting. By leveraging historical data, statistical models, and machine learning algorithms, these tools can predict future financial outcomes with greater accuracy. Embracing predictive analytics in your FP&A endeavors will give you an edge in predicting market trends and making proactive decisions.

The Impact of AI

Artificial Intelligence is transforming the way FP&A tools operate. AI algorithms can analyze vast amounts of financial data, identify patterns, and provide real-time insights. With AI-powered tools, you'll be able to automate repetitive tasks, improve forecast accuracy, and uncover valuable business insights that were once buried in data overload.